In this article, we discuss the importance of customer experience when it comes to conversion rate optimization, and we explore ways you can improve your user journey to convert more browsers into buyers.

Conversion rate optimization can be a great opportunity for businesses of any size. It enables businesses to convert more visitors into customers, and effective CRO can lead to better user experience and increased sales.

We hope you’ll find our beginner’s guide insightful, and learn new things that will help you find ways to optimize your own website in time for this year's shopping season.

So first things first...

What is conversion rate optimization?

Conversion rate optimization is an important part of online marketing. The CRO ‘science’ consists in optimizing your website in order to increase to likelihood that visitors will complete a specific action, or at least get closer to a desired goal – purchase a product or service, call, book a demo, etc.

The average eCommerce conversion rate is about 2.86%. This means that 97.14% of visitors leave most websites without completing the customer journey. That's a lot of businesses who haven't put a marketing funnel optimization in place.

In this article, we’ll explain how conversion rate optimization and content-driven conversions can help you convert the remaining 97%.

Trustpilot's beginner’s guide to CRO – 8 things to try today

Now that you know what conversion rate optimization is, and how it can benefit your business, this section is dedicated to helping you find ways to optimize your pages.

We’ve put together eight tips for beginners that will hopefully help your business achieve better CRO results.

Let’s get started!

1. Simplify your site with clear calls to action

If you don’t have an eye for design, making your website visually appealing can be challenging. A website’s homepage needs to have marketing funnel optimization taken into consideration when its designed — that is, it must be inviting and easy-to-navigate in order for visitors to go down your funnel and convert.

It only takes visitors two tenths of a second to form a first impression on your business looking at your website, so remember that simplicity is key.

Your calls to action (CTAs) are your best closer, but it’s easy to go wrong. In order to increase your conversion rate, your CTAs must be clear, visible, and most of all, clickable. No need to insert five different CTAs per page. One is enough, because the more calls to action a page has, the less likely it is that your customers will click on each one of them, or on any at all.

To make sure your pages are optimized, opt for a unique and clear goal per page, and therefore a single CTA - from booking a demo, to calling, adding a product to a basket, or checking out, remember: one CTA per page is the golden rule. No marketing funnel optimization strategy is successful without a clear path through the funnel and one CTA per page to guide them to the bottom.

Spotify's homepage has a clear and simple call-to-action.

2. Offer a good user experience

At Trustpilot, we want to help you build great user experiences. We believe we can help you boost your conversion rate by optimizing and fixing minor user experience problems.

Responsive design

Adopting a responsive design means your website layout will fit and adjust to any viewing device your visitors might be using. This will considerably improve customer experience, and therefore influence your conversions.

Example of responsive design

Loading time

According to KissMetrics, nearly half of consumers would wait only up to 10 seconds for a site to load before abandoning it. This means a 1-second delay could cost you a 7% conversion decrease!

A slow loading time is also likely to decrease your customer satisfaction and the probability that visitors will come back to your site. With this in mind, it’s easy to see how loading speed can impact conversion rates. Simply making your website faster with tools like Pingdom can help you convert more.

3. Invest in a good search bar

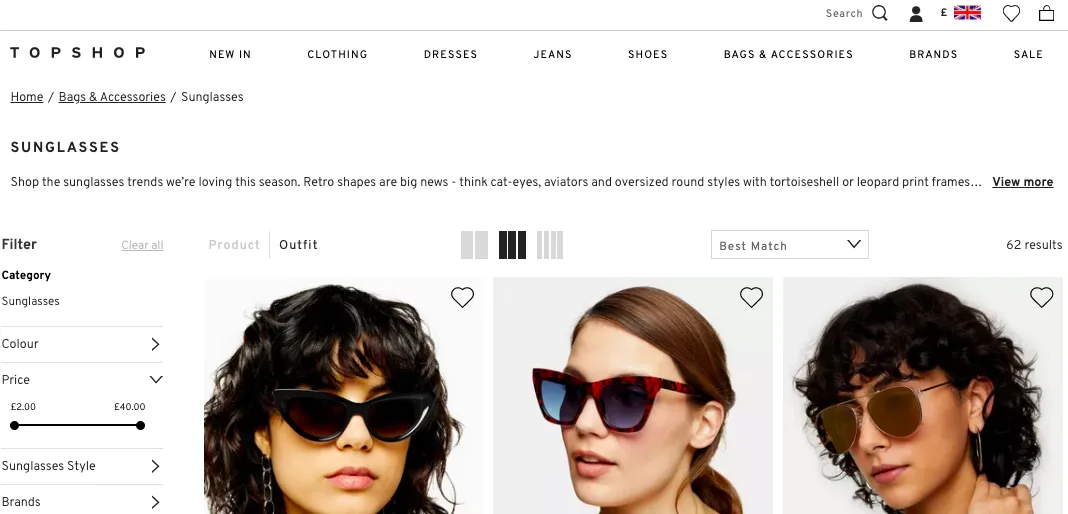

During its own conversion rate optimization analyses, Topshop noticed that customers were having difficulty finding and using the internal search box, and that visitors who managed to use it properly converted 10 times higher than others. After doing some extensive testing, Topshop was able to improve its search box design, and increase its conversion rate by 5.8%.

A good search bar allows your visitors to skip through the customer journey and go straight to the product they’re interested in, and eventually, the checkout page. The search bar can be seen as a conversion ‘shortcut’, and is essential if you offer a wide variety of products.

Topshop’s search bar (top right) allows you to find products faster

4. A/B test your landing pages

You’ve got a landing page, but you’re not sure how to optimize it for conversions.

A/B testing is the way to go.

Indeed, A/B testing allows you to experiment, test two different strategies against each other, and compare the results in order to find the best option for both you and your visitors.

It can usually last for as long as needed, or until one of the two strategies is clearly more successful than the other. Here’s a list of things you can A/B test in order to optimize your landing page’s conversion rate:

Your landing page’s image

Your landing page’s unique selling proposition

Your landing page’s CTA

Your landing page’s content (list of benefits, customer reviews, trust symbols…)

Your landing page’s colours

Once you have enough data points to mark a significant result, you can opt for the better performing option, knowing you’ll increase your conversions.

J7 Media – a Trustpilot partner – manages the ads and landing pages for eCommerce clients and always performs A/B tests to determine what generates the most value. To better understand how A/B testing works, we asked the experts at J7 to share what they've learned. Here's what they have to say.

"A/B testing is a must-do in your conversion optimization process. When planning for an A/B test, there are two types of pages you might want to improve on.

The first type is an under-performing page. If your funnel analysis points to a page on which there’s a lot of traffic but very few conversions, try looking at the consumers' landing page experience and putting yourself in their shoes. It’s an easy way to find potential friction points. You can then try an A/B test removing those barriers.

The second type is a well-performing page. Sometimes we simply want to see if our best pages can still be improved upon. In both scenarios, many parts of your page can be tested to improve their conversion rate."

J7 also shared some ideas to jumpstart your reflection on your next A/B test:

Focus first on the above portion of your page. It’s the most important part.

Think mobile-first. In digital marketing, a wide portion of the audience often comes from mobile. Make sure their experience is just as good as the ones who are shopping from their desktop.

Test different copywriting and images variations.

Make sure customers see your products in all their glory.

Match the copy and imagery from the ads linking to the landing page. Try using Dynamic text replacement, if possible.

Ultimately, data is king, so it's important to make sure you keep track of all relevant key performance indicators before, during, and after your A/B tests on each landing page. You will accumulate relevant information for future tests that could save you time and money.

If you'd like to learn more about improving conversions on ads and landing pages, visit J7 Media today.

5. Make sure your contact page is comprehensive

Whether you’re a B2C or a B2B business, your contact page is more important than you think it is.

Far too many companies put their contact details in their website’s footer, just ‘give up’ on their contact page, and hope for the best.

Big mistake!

Your ‘Contact us’ page is one of the most important and most visited pages of your website.

That’s why we think these are important:

Include a reason to contact your business, how you can help, etc.

Don't forget your company’s phone number and email.

The shorter the form, the better. Include fields like ‘Name’ and ‘Email’, but don’t overdo it.

A single, clear call-to-action will reduce your bounce rate.

Link to your company’s social media accounts, just in case visitors would rather contact you via Facebook, Twitter, or Instagram, or want to get to know you better first!

If they complete the form, make sure to send them a ‘Thank you’ message. Consumers like to know when their problem is being looked at.

6. Increase fear of missing out (FOMO)

Using live data can help increase your visitors’ fear of missing out, and push them to make a decision faster, based on the ‘wisdom of the crowd’.

Live data is usually used directly on product pages and can considerably improve your conversion rate.

This can include anything considered as ‘social proof’: from the number of visitors currently looking at your product, to the number of people who bought this item over the last 24 hours, other similar items people who have looked at this page ended up purchasing, your bestsellers, and much more.

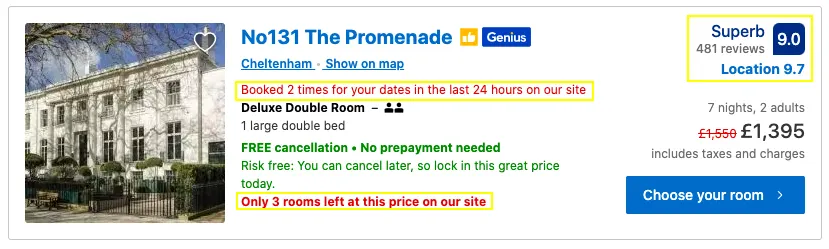

Below is a great example of how Booking.com uses live data as social proof to optimize conversions on their product pages:

Booking.com uses live data as social proof to convert customers

7. Add reviews and testimonials for more content-driven conversions

We all know how easy it is to compare businesses by price, shipping cost, quality, and customer experience when we shop online. Unfortunately, that only makes it harder for brands to stand out, and therefore to retain and convert online shoppers.

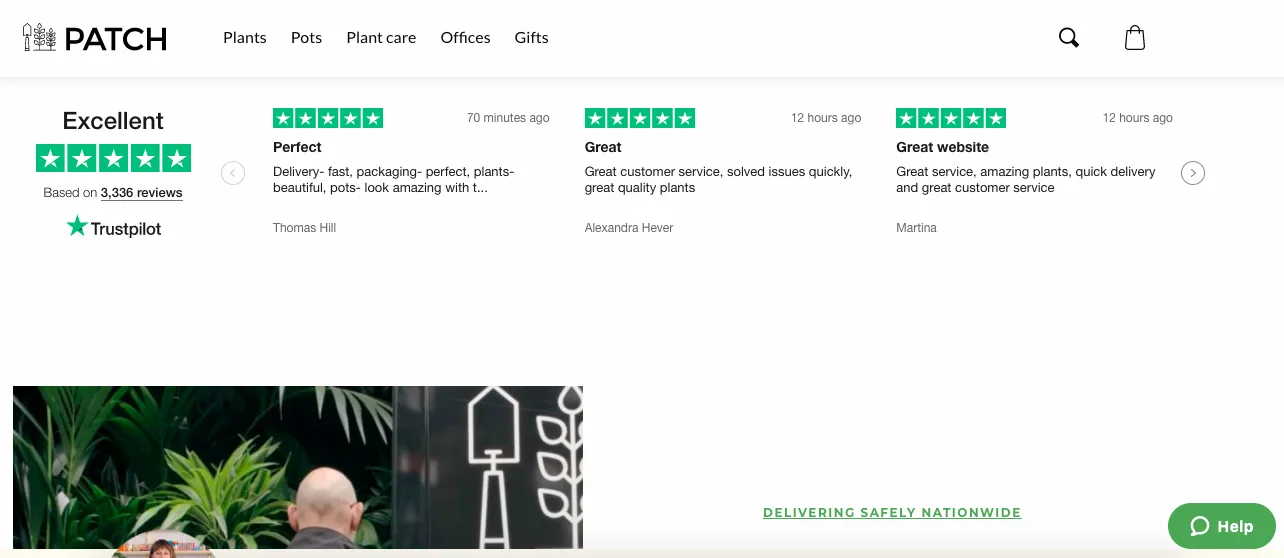

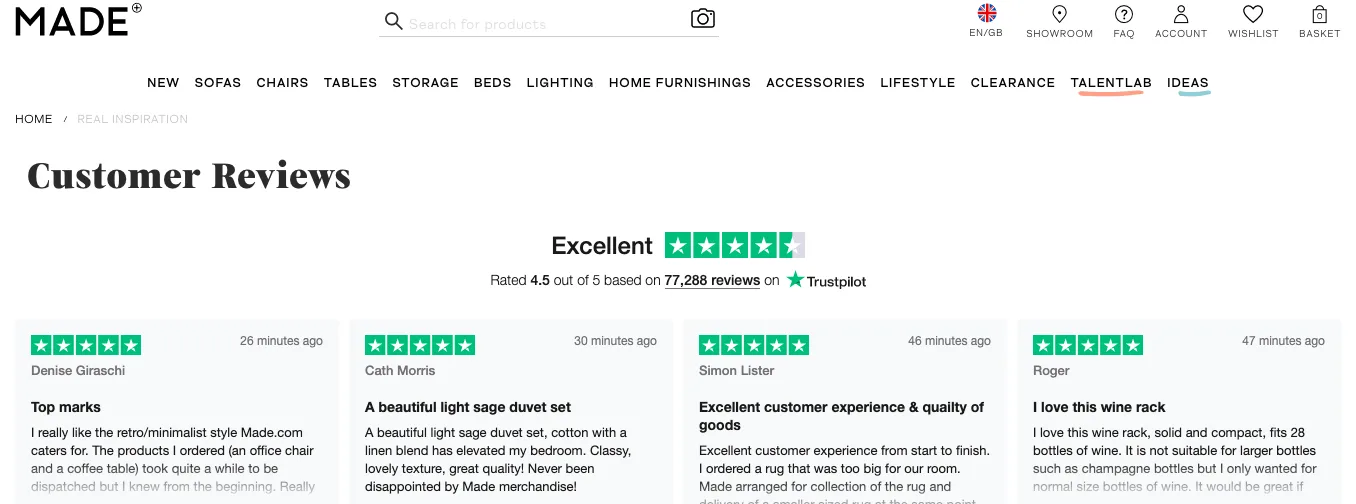

Today, 89% of global consumers check online reviews as part of their online buying journey, and 49% of global consumers consider positive reviews one of their top 3 purchase influences. This means that 89% of all consumers will be looking for third-party validation when comparing different products or services.

That’s why adding customer testimonials or online reviews to your ads or website can help build trust earlier in the funnel, reduce your bounce rate, and convert more visitors whilst creating better user experiences.

Trustpilot data shows that 87% of consumers find ads more trustworthy with the Trustpilot trust mark, even when there are only four stars.

Below are some examples of brands leveraging Trustpilot reviews to convert with valid content in their customer journey:

8. Don’t risk losing customers at checkout

Offer a guest checkout option

Did you know that having to create a new user account is the second biggest reason for cart abandonment (22%)?

Guest checkout can help keep all bottom of funnel visitors stay engaged with your brand, whether they’re repeat or first-time buyers.

Most consumers don’t want to create an account every time they order from a new website, so why not offer a guest checkout option?

You can always email them afterward, and ask if they’d like to create an account.

Free shipping is always a winner

Shipping cost is the number one reason for cart abandonment (25%), and 9 out of 10 consumers say free shipping is their biggest incentive to continue shopping online.

Charging for shipping could mean you’re losing some of your sales. As a solution, you could offer free shipping on all orders, have a minimum spend requirement, or simply give free shipping to shoppers for a limited period of time.

Payment options are important

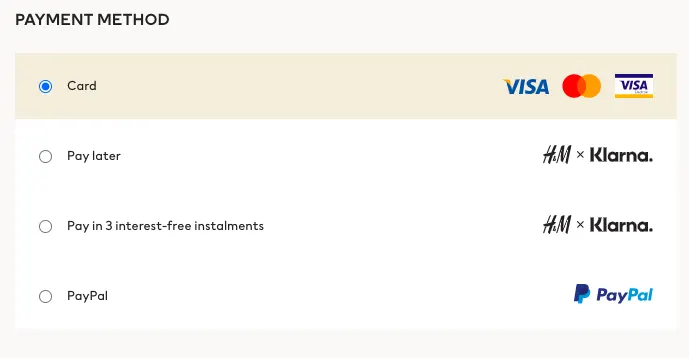

Did you know that 59% of buyers will abandon a transaction if their prefered

payment method isn’t available? All customers are different, which is why your website should offer as many payment options as possible.

Having multiple payment options means you’re likely to convert more visitors into customers. Don’t risk losing visitors who’ve made it down the funnel!

Here’s a great example of varied payment options: H&M offers its customers different types of payment methods, including Klarna.

H&M offers different payment options, including 'Pay later' with Klarna

9. Build a marketing funnel optimization strategy

Each of the previous strategies helps you build one important piece of the puzzle. But focusing on marketing funnel optimization helps you put all of those pieces together. When you want to convert a new customer you need to have a clear path from the first page they land on, all the way to that final conversion.

Having a lot of different pages that are optimized to convert will help you complete the action on that specific page, but without marketing funnel optimization they'll only be completing that action. With a full funnel strategy, you can take them through the exact journey you've designed for them. And the more you include your customer reviews throughout your funnel, the more content-driven conversions your brand will see.

If you'd like to learn more about how reviews can help you convert at each stage of the funnel, check out our complete guide to reviews.